To:

Homeowners Insurance Underwriting Executives

Insurance Sales & Marketing Professionals

Business Development Team Leaders & Actuarial Managers

From: Peter M. Wells Business Group (PMWBG)

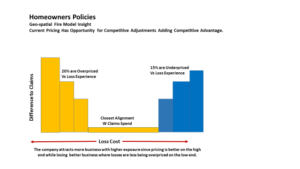

Re: For Homeowners Insurance, Geo-spatial “Behavior” Data Demonstrates in 10 Million Cases to Deliver Millions in Fresh Sales Opportunity While Improving Competitive Position and Pricing

There are three primary drivers of loss in the P&C industry that although randomly occurring, carriers strive to predict. These include catastrophic events, mechanical breakdown or physical disruption, and behavioral driven occurrences. Catastrophic events have warning signals but are difficult to predict when and to what extent they will occur so fall into the category of non-standard losses. Predicting mechanical breakdown in buildings and facilities is now becoming easier with the invention of “life-cycle” analytic tools introduced in 2014 by the Wells Group. Which leaves a major category of loss events driven by behavior of individuals in set geography, a category that to date has only been addressed under the banner of credit. Unfortunately, while credit is helpful, it is indirectly aligned with causation and is also rejected by over 12 states carriers where now write property business.

Open the following link to view this Bulletin:

Adding Behavior to Other Indicators: Research performed by the Wells Group in connection with our partners LocationInc™ and Whitestone Research shows that 22% of non-catastrophic property losses are driven by mechanical and/or age related breakdowns, with as much as 55% of other loss events in both…

|

|

Adding Behavior to Other Indicators: Research performed by the Wells Group in connection with our partners LocationInc™ and Whitestone Research shows that 22% of non-catastrophic property losses are driven by mechanical and/or age related breakdowns, with as much as 55% of other loss events in both structural, contents and liability claims having a strong behavioral component. Predicting behavior exposures with new data algorithms adds significant advantage and overall underwriting lift.

Outside today’s credit analytics, the true impact from behavior has not been studied extensively. However The Wells Group and its partners are |

now defining new and critical drivers from than 18,000 unique data sources and, for the first time, recognizing strong insurance correlations aligned with behavior for predictors of fire, crime, wind, vandalism, arson and more. We’ve also taken it a step further applying the data variables in new scores through per-policy geo-coding directly associated to where business is written.

The Wells Group works with information providers to develop next generation technologies insurance companies can deploy in their day-to-day operations to improve the financial picture and generate significant earnings upside. Now, by filtering new data variables through the prism of geo-spatial territorial alignment, data variables for key loss categories emerge associated to more for over 3 billion location points across the U.S. landscape. As much a visual as a score, the new picture that emerges not only impacts risk selection, risk management and pricing, but when calibrated in a unique way we train, also reveals large pockets of new business opportunity once thought a saturated marketplace.

For example, testing the new FIRE Score on millions of homeowners’ policies in addition to 22 other variables carriers already employ new pricing advantage was found and fresh advantage uncovering potential adverse selection within rating territories.

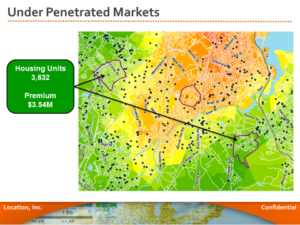

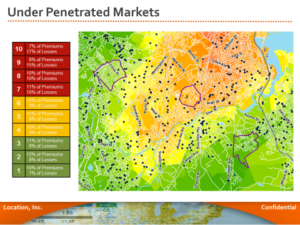

Using advanced geo-spatial filters with new exposure variables is also proven to peel away the veil over today’s business landscape to reveal more new sales opportunity than was earlier predicted. Today’s home insurance market is depressed from the glory days before the 2007 housing crash, so supply is chasing a greatly reduced demand. Companies that grow their earnings will do so in non-traditional ways including looking differently at sales territories. Under the microscope of Wells Group geo-spatial scores a new landscape emerges for each territory uncovering hidden opportunity sectors and ultimately new sales leads.

Action Steps to find new business include laying out the policy count across existing geography, then overlaying our peril filters for key exposures exposing fresh opportunity missed before for savvy business leaders.

|

Using geo spatial Peril Filters & Scores Property business in existing territories emerge in fresh view of their exposures with new pockets of sales opportunity uncovered otherwise missed before. |

We want your company to learn more about this technology and how it applies to the insurance underwriting, rating and sales process. Please phone us to arrange a demonstration. Contact . . .

Peter Wells

Peter M. Wells Business Group, LLC

262-347-6091