To:

Insurance Underwriting and Claims Executives

Business Development and Loss Prevention Team Leaders

From: Peter M. Wells Business Group (PMWBG)

Re:

Insurance Technology Update – Building Component Failure Predictive Solution

Top 4 U.S. Homeowners Writer Verifies Efficacy of Life Cycle Cost (LCC) Predictive Scores Carrier Reports Program Highly Predictive of Residential Loss Concerns / Adding Lift.

Open the following link to view this Bulletin:

Discussion:

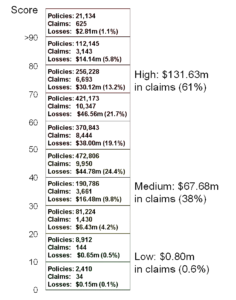

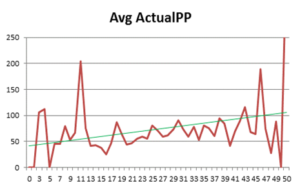

With nearly 27 million residential property records having now been studied from five top homeowners insurance writers, and with a new, comprehensive multi-year analysis performed by a top 4 U.S. carrier, results demonstrate that Life-cycle Cost (LCC) Data and Analytics from Peter M Wells Business Group is highly predictive of property claims from component failure and should become an actionable new variable in loss prevention, sales positioning and overall competitive pricing models for U.S. property writers. The impact is projected to be as much as $11 billion in loss savings for the homeowners’ side of the P&C marketplace, with at least $5 billion in premium lift annually. Success is derived from knowing in advance which major systems in homes will fail in the coming policy cycle so action can be taken on a risk specific basis.

Analysis shows that as many as 90% of the homeowners property claims insurers pay are now able to be forecasted for life-cycle exposure using the LCC scoring system with details on what will mature and fail annually in each home. Because of the extreme detail in LCC models, LCC data is effective writing new policies, but has a major impact when run against existing business that never had this kind of analytics review before. Other advantages carriers find include . . .

|

Age Scores Carriers Build Themselves

|

Industry findings show LCC reliably predicts loss experience offering a substitute to less property specific programs. |

|||||||||

LCC SCORES

|

|

|||||||||

For more information, contact:

Peter M Wells Business Group

262-347-6091

petermwells@peterwells.us